does arizona have a solar tax credit

A tax credit lowers the amount of taxes you have to pay. Can I still file.

Is The Federal Tax Credit For Solar Panels Going Away In 2020 Solar Solution Az

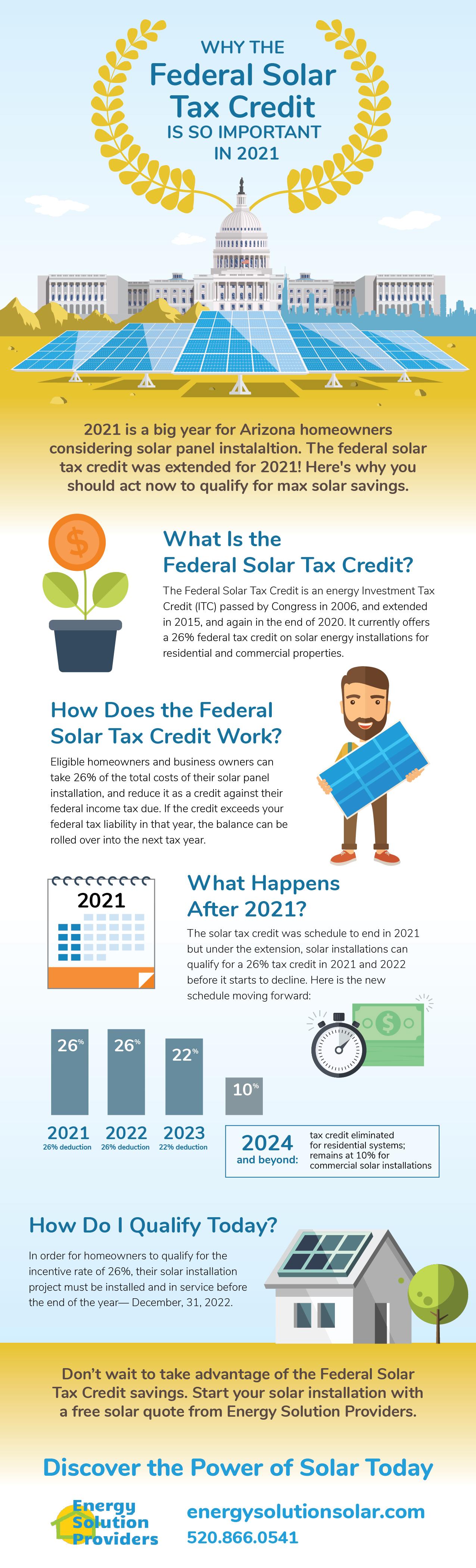

Note that the federal tax credit is available for all homeowners who purchase a system whether they buy it outright or finance it with a solar loan but it is not available to those who lease solar panels.

. Department of State webpage for more information. This incentive allows you to deduct 26 percent of the cost of installing solar panels from your federal taxes and theres no cap on its value. If you get a refund instead of owing you can still qualify for the tax credit as long as the amount of taxes you have paid throughout the year is higher than the credit you are claiming.

For example a 10 kW system priced at the national average 276W comes out to 27600. To take full advantage of the federal tax credit make sure your solar energy system is installed by 2022. This is a beautiful and clean looking solution for asphalt roofs.

This bill was passed to help solve energy problems and provide tax incentives for existing and new types of energy production including wind and solar. Plug-In Hybrid and Zero Emission Light-Duty Vehicle Rebates. Our new Solar SlantBlaster fan is the solution you need on your asphalt roofed home.

The spaces are available on a first-come first-served basis. The most widely available incentive is the federal tax credit currently set at 26. DSIRE is the most comprehensive source of information on incentives and policies that support renewables and energy efficiency in the United States.

The office is closed on. Its also very important to state that solar farms typically require less maintenance than other forms of energy generation but they can still have a dramatic effect on the local surroundings. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal incentives and rebates.

However with the ITC youd be. Reports have it that the quick expansion in the solar industry came as a result of two major factors. Any taxpayer who pays for a solar panel installation can claim the solar tax credit as long as they have tax liability in the year of installation.

How does a solar panel business make money. My Arizona Solar tax credit exceeds my Arizona tax liability. At the time the credit only lasted through 2007 but it was so successful that it was extended.

Sign Up for Email Updates. Tax Credits Rebates. We have solar-powered the popular slant back roof vents.

Is 277 per watt 27700 for a 10-kilowatt system. Incentives for solar and batteries are also important components of the overall cost of a solar system. Passport applicants may park in three complimentary parking spaces.

The federal solar tax credit also known as the solar investment tax credit or ITC offers new solar owners in the United States a tax credit equal to 26 of costs they paid for their solar installation. Thats not so surprisingWe dont actually have state income tax after all. The first of its kind.

University Drive Suite 111 Tempe AZ 85281. And with your forged signature solar companies will sometimes pull your credit report without your consent a violation of the federal Fair Credit Reporting Act. Rebates for the purchase or leasing of AEVs and PHEVs with vehicles.

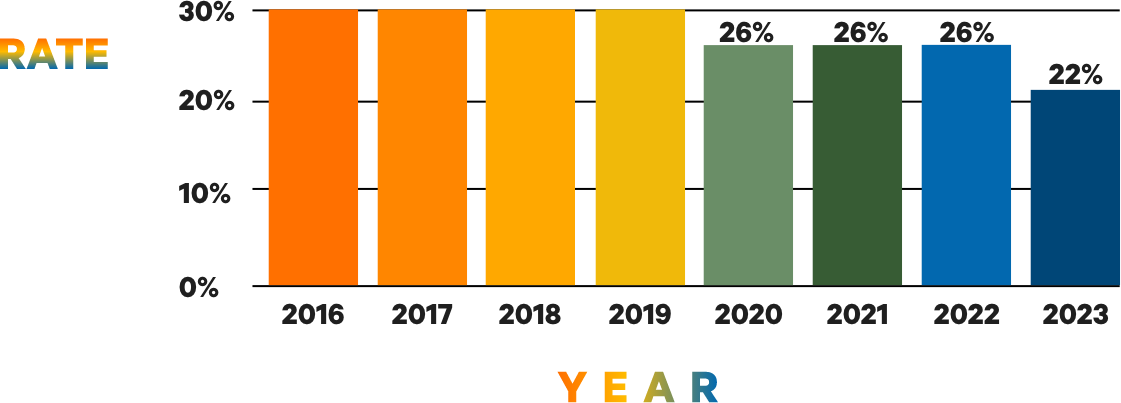

The ITC is designed to step down to 22 in 2023 and then settle at a permanent rate of 10 for commercial solar installations and will be eliminated for homes starting on. Grants are funding given to promote renewable energy that does not have to be paid back. Credit for solar energy devices.

Qualifying groups include low-income or rural homeowners farms Native American tribes schools and nonprofit organizations. Whether you work with a franchise or wholesaler your installation business makes money through the successful installation of solar units. Now it also comes in the Mega version with a bigger fan and solar panel.

The credit decreases to 22 for systems installed in 2023. So the only tax credit you can claim is the ITC that the federal government offers. Facebook Twitter Youtube Instagram Linkedin.

The rise of solar energy scams In New Mexico the state accused Vivint Solar of using deceptive business practices by tying consumers into 20-year contracts that forced them to buy the electricity produced by the. How much does a 10kW solar system cost. Arizona State University 1100 E.

As of January 2022 the average cost of solar in the US. For example if you are required to pay 1000 in taxes and have a tax credit of 300 you then only owe 700. The best incentive for going solar in the country is the federal solar tax credit or the investment tax credit ITC.

But no need to be gluma 30 cut in your expense is a pretty big deal. That means that the total cost for a 10kW solar system would be 20498 after the federal tax credit discount not factoring in any additional state rebates or incentives. Photovoltaic cells convert light into an.

You allocated 205 more credits than your Arizona tax liability This is for form 310. Solar power is the conversion of renewable energy from sunlight into electricity either directly using photovoltaics PV indirectly using concentrated solar power or a combinationConcentrated solar power systems use lenses or mirrors and solar tracking systems to focus a large area of sunlight into a small beam. Tennessee doesnt currently have a tax credit for homeowners switching to solar.

Government programs like the Investment Tax Credit ITC. What is the tax credit and how does it work. The initial federal investment tax credit was part of the Energy Policy Act of 2005.

A Federal Housing Administration loan is a low-cost loan to help homeowners install energy saving upgrades to their homes or purchase a new home that. Monday through Friday 830 am. Some leasing programs generate regular income by charging their customers a monthly bill which includes the cost of the panel installation and any extra power the.

If you are eligible for a state tax credit you. SW Washington DC 20585 202-586-5000. Comes in two colors.

There are other important incentives as well depending on location such as New Yorks 25 state tax credit and Californias SGIP program for solar. Residential Electric Vehicle Supply Equipment EVSE Tax Credit Tax credit of up to 75 for the installation of EVSE in a house or housing unit an individual has built.

How The Solar Tax Credit Works Youtube

Solar Tax Credit In 2021 Southface Solar Electric Az

The Extended 26 Solar Tax Credit Critical Factors To Know

Solar Tax Benefits In Phoenix Arizona Solar Incentives

Tax Credits For Installing Solar Panels

Solar Panels For Your Home What To Ask In 2020 Chariot Energy

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

2021 Solar Tax Credit Sunsolar Solutions

Solar Investment Tax Credit Harmon Solar

The Federal Solar Tax Credit Energy Solution Providers Arizona

Canadian Solar Incentives Rebates And Tax Credit Programs Federal Provincial

Generac Power Systems Customer Support For Generac Generators Pressure Washers And Power Equipment

Arizona Solar Incentives And Rebates 2022 Solar Metric

Guide To Federal Solar Investment Tax Credit Rooftop Solar

Solar Panel Incentives Rebates Tax Credits A Definitive Guide

Arizona Solar Tax Credit Other Incentives Available In 2022 Ecowatch

How The Solar Tax Credit Makes Renewable Energy Affordable